Aboutorabidar: Reforming the banking system is the first step to strengthening the country's economy

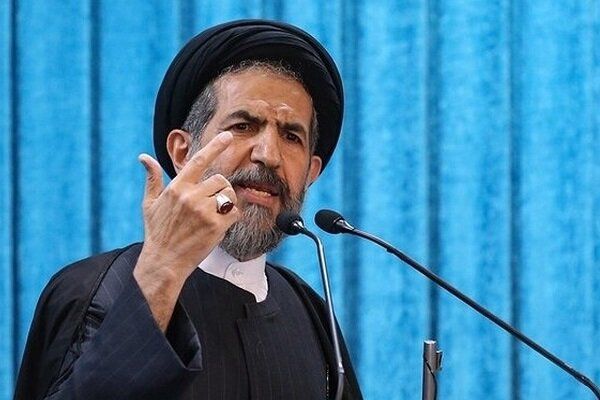

Referring to the imbalance of the Ayandeh Bank, Tehran's interim Friday prayer leader said that legal action and reform of the banking system are the first steps to curb inflation and strengthen the country's economy.

According to Ashura News, quoted by Mehr News Agency, Hojjatoleslam Seyyed Mohammad Hassan Abu Torabifard, the interim Imam of Tehran, in his Friday prayer sermons at the University of Tehran, while recommending adherence to divine piety, said: "In order to reach high levels of piety and adornment with human perfections, God Almighty has provided mankind and human society with three precious gems. If we recognize these three blazing torches, gain knowledge, and move in the light of their light, the highest levels of perfection and happiness will undoubtedly be achieved for mankind and human society."

He added: "The first precious and blazing gem, by adorning which man reaches high levels, is the blazing torch of reason, which is what distinguishes man from other phenomena, and rational life is human life."

Hojjatoleslam Seyyed Mohammad Hassan Abu Torabifard, the interim Friday prayer leader of Tehran, while honoring the memory of martyred generals Tehrani Moghaddam and Hajizadeh, said: Martyr Hajizadeh, a prominent scientist and the father of Iran’s missile industry, and martyred general Tehrani Moghaddam, a brave and authoritative commander of the Aerospace Forces of the Revolutionary Guards, together with their brave comrades, created power for the Iranian nation, the Islamic Ummah, and the Axis of Resistance, and paved the way for the honor and authority of the Islamic nation. I hope that these bright stars, who were educated in the Ashura School and the Ahlul Bayt School, will always inspire the Islamic nation.

In another part of his speech, referring to the dissolution of Ayandeh Bank, the interim Friday prayer leader of Tehran added: Imbalance means that the value of assets is less than the value of liabilities. An unbalanced bank is a bank whose liabilities are greater than its assets. This situation can be one of the most important factors in the lack of stability in the macro economy. Organizing or eliminating unhealthy banks, while preventing unhealthy competition in the money market, has an effective effect on reforming the banking network and strengthening economic stability.

The Friday prayer leader of Tehran stated: On 04/07/1402, that is, about two years ago, the Research Center of the Islamic Consultative Assembly examined the situation of Ayandeh Bank and reported that the conditions of this bank are very unfavorable. According to this report, the indicators and indicators of Ayandeh Bank—including an overdraft of 80 trillion tomans by the end of Khordad 1402, a high share of doubtful receivables, and a negative capital adequacy ratio of 140 percent in 1401—indicate the defective structure of income, costs, and asset imbalances of this bank. The report also states that measures such as revaluation do not produce serious improvement, and the downward and critical trend of the indicators shows that over time, the costs of resolving the bank's imbalances will increase. Finally, it is recommended that immediate law enforcement and judicial action be taken to stop the process of indiscipline in Ayandeh Bank.

Hojjatoleslam Abutorabifard continued: “For various reasons, including legal loopholes, it was not possible to deal with this bank quickly. Fortunately, with the approval of the new Central Bank Law, the Central Bank was provided with the necessary executive tools to deal with unbalanced banks. According to the Central Bank Governor, 42 percent of the imbalance of the entire banking system of the country and 42 percent of the overdraft from the Central Bank is related to Ayandeh Bank, which is a very important issue and a cause for serious concern.”

He added: “I was thinking to myself, did the sanctions have an effect on the formation of this major violation? Or should the sanctions have made our will more serious and determined to defend the capital of the Iranian nation?”

Hojjatoleslam Abutorabifard stated: “In recent years, the Bank of the Future had become a center of imbalance in the banking network due to high accumulation of losses, extensive debt to the Central Bank, payment of unreasonable profits to depositors, and granting large facilities to affiliated companies and individuals, and ultimately took the path of merging with the National Bank.”

The interim Friday prayer leader of Tehran thanked the Council of Heads of Power, the Presidency of the Judiciary, and concerned representatives who paved the way for the implementation of this process by the Central Bank.

He continued: “Global experience shows that curbing inflation, maintaining the value of the national currency, and sustainable economic growth are not possible without reforming the banking system and the unbalanced banking network. Reforming banks and directing resources towards high-value-added production is the first step and the most necessary measure to strengthen the country’s economy.”

Referring to financial policies and budget imbalances, Hojjatoleslam Aboutorabifard also said: "The directors of the Planning and Budget Organization and the esteemed President are determined to reform the budget so that, in response to the directives of the Supreme Leader of the Revolution, the foundations of the country's economy can be strengthened; a difficult but necessary task for the future of the Iranian economy."

Hojjatoleslam Abutorabifard said: One of the esteemed deputies of the Planning and Budget Organization recently told me, he said, the only manager I had a meeting with and reported to and explained that the necessity of cost management today is to prevent unnecessary cost increases as much as we can, and today our main issue is to improve resource efficiency. I explained, and after my explanation, he said that I will cooperate with you fully in this area, only the current president of Tehran University was. How regrettable this statement was.

He continued: Why are the country's managers not accompanying us? Esteemed managers, God is witness, today the demand of the martyrs of the 12-day war is to increase productivity, not your budget; use the resources you have better as much as you can. Reduce the consumption of the treasury as much as you can, even by one rial. Provide the possibility of increasing income and creating wealth as much as you can.

The interim Friday prayer leader stated: Budget imbalance is one of the main issues and important problems of our banking system. They finance the budget deficit from the banking network, they finance the budget deficit from the reserves of the Central Bank. This means inflation growth; the continuous encroachment of executive bodies on the resources of banks and the resources of the Central Bank institutionalizes monetary indiscipline; that is, it makes our banking network inefficient. It seems that correct monetary policymaking and providing the basis and operational framework for implementing monetary policies and efficient supervision of banking network operations and reducing the financial dominance of the government depend on institutional reforms of the Central Bank in the two areas of monetary policy and banking supervision policy. Also, observing the principles of transparency in policymaking is an inevitable necessity, and this important matter, that is, the transformation of the country's Central Bank, is due to the independence of the Central Bank.

The Friday prayer leader in Tehran stated: The Central Bank must be independent. It must set goals to maintain the value of the national currency. If the Central Bank did not have independence, it could not set goals. He must plan and clearly announce his plan. He must be accountable. If he is not independent, he is not accountable. The independence of the Central Bank provides the possibility of institutional, political and policy reforms, as well as appropriate monetary policymaking and the effective implementation of those policies on the economy.

He continued: Explaining the central bank’s core mission in maintaining the value of the national currency and clearly stating official goals, explaining priorities precisely, operational transparency and ultimately the central bank’s accountability for its decisions and actions are essential approaches. Another approach is the special position and independence of the central bank, which must be achieved. If, in the first step, the banking network’s interference with the central bank’s resources is stopped quickly, as happened in the Ayandeh Bank, it is very unfortunate because this process must be stopped in the first step. In the second step, proper planning is necessary to reduce and stop the government’s interference with the central bank’s resources.

Hojjatoleslam Abutorabi Fard said: This will be achieved through reforming the budgeting system, through productivity, through reducing costs and increasing tax revenues, through preventing tax evasion and increasing tax bases. On the other hand, by emphasizing the necessity and importance of monitoring failed banks and exercising strict supervision to prevent the repetition of this bitter event, the Central Bank should not allow us to face such issues in the future. From the perspective of observers, if the process of escaping, resolving, and merging Ayandeh Bank into Bank Melli is accompanied by intelligent policymaking and strengthening banking supervision, it can be a starting point for serious reforms in the country's banking network and a successful model for the exit of failed and risky banks from the country's banking system.

Post a comment